Today’s world – and its political and social institutions alike – is increasingly marked by disruption. Similarly, the esports landscape is experiencing a period of rapid change. From the continued investment by the traditional sports world to the growing battle for media rights, 2017 is shaping up as an inflection point for industry growth.

Yet, the business of esports is still nascent. Industry revenue is expected to come in shy of $700 million, albeit with a year-on-year growth of 41.3% (Newzoo). Consequently, it’s important to understand how macro level shifts will affect commercial opportunities. The following are three leading commercial trends in esports for 2017 and beyond.

Trust is a major issue

Social media, video viewing and gaming accounted for 42% of ALL U.S. internet time in 2016 – according to comScore. Esports sits squarely on the nexus of all three. This bodes well for continued audience growth. Yet, esports content lives on digital platforms that continue to struggle with advertiser trust.

For example, Google – parent company of YouTube –was hit hard by the withdrawal of spend from several blue chip brands including L’Oreal, Verizon and AT&T. YouTube previously bought exclusive rights to FaceIt’s ECS league so it could sell that content to similar partners and clients. Yet, those sales are dependent on the ability to avoid the pitfalls it succumbed to (see image below).

Courtesy of eMarketer

Issues like click fraud, bot traffic and ad blocking are general concerns for marketers and agencies when it comes to digital media. For platforms like Facebook, YouTube, and Twitch, maximizing esports content monetization depends on effectively addressing these issues – not the other way around. Likewise, non-endemic brand penetration in esports is directly related to the quality of solutions.

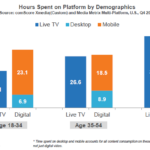

Additionally, these challenges affect industry growth. Since esports marketing practices – sponsorship, influencer marketing, etc. – are critical sources of revenue. As long as digital media concerns remain top-of-mind, brands and advertisers are likely to continue the push for esports content on linear TV. Even in the face of a massive shift in media consumption: e.g. Millennials in the U.S. already spend 4 billion more hours on mobile than they do watching live TV (comScore).

Courtesy of comScore

Deal flood

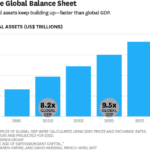

According to the Harvard Business Review, this is an era of superabundant capital. Where there’s a lot of money chasing a few good ideas. Bain & Company presents analysis that this could continue for the next 20 years. If true, the formative years of the esports industry will be fundamentally shaped by the notion that financial capital is no longer a scarce resource.

Courtesy of Harvard Business Review

Investors have already shown a willingness to purchase esports teams, despite a murky ROI picture. In spite of the fact there hasn’t been a notable exit for an esports-related enterprise since 2014 – Amazon’s Twitch acquisition. However, with superabundant capital available it’s reasonable to assume that the scope and scale of esports investments will grow nonetheless.

Similarly, the trend of tech/media/entertainment companies merging esports and interactive media into existing lines of business should only continue. Expect western firms to emulate Amazon’s multi-channel approach to monetizing gaming entertainment. Especially since Chinese conglomerates, like Tencent and Alibaba, are already aggressively active (more on this later).

Outlook: More investment around game ecosystems puts the onus on publishers to – as Ed Chang highlighted – embrace a third-party ecosystem, or miss a billion dollar opportunity. There is a lucrative future for games as global platforms, not only for consumers (B2C), but other businesses (B2B).

All eyes on China

The home of esports might be South Korea but its future is being heavily influenced by China. Competitive gaming is a vibrant part of the Chinese government’s target to create an $813 billion USD sports industry by 2025. For instance, esports is among 13 new college majors for the fall of 2017. Chinese universities now offer a degree in esports alongside disciplines of law, English, and sports management.

The competitive rivalry between Alibaba and Tencent, has also found its way to the esports sector. Tencent leveraged esports investments to post annual revenue of $21.9 billion in 2016 and push its market share ($270 billion) past Alibaba’s ($262 billion).

A growing urban middle class is fueling rising levels of discretionary spend. Gaming and other forms of consumer technology are key drivers for capturing as much. Hence Tencent’s purchase of Riot Games, the Alibaba sports spinoff (Alisports) plans to pour $150 million into esports, and an investment fund looking at bringing Western games to the Chinese market.

Outlook: The race to reach the Chinese consumer is on. China’s focus on gaming and esports will help bridge the gap between the West and a domestic market of over 520 million gamers. Further, growth of competitive gaming in China is a key health indicator of what is a global industry.