“In making decisions under conditions of uncertainty, the consequences must dominate the probabilities.”

— Peter L. Bernstein

Here come the cowboys. AdAge reports that the National Football League’s Dallas Cowboys are considering purchasing an esports team. According to Forbes, the Cowboys are the most valuable sports club in the world’s most valuable league. So this isn’t insignificant news. However, the AdAge article raises some caution flags:

“When it comes to something like e-sports, it makes so much sense for us because we’re such a sales driven organization,” said Matt O’Neil, senior VP of brand marketing for the Dallas Cowboys. “If we thought we could buy a team for — gimme a number — $2 million, $3 million, $5 million or whatever, but get $7 million in sponsorship deals over the next couple years it becomes a no-brainer.”

Namely, is any investment in an esports team today truly a “no-brainer?” To determine as much, here are three realities to consider:

The cost of loss

The first rule in sports is, don’t lose. Yet, investments are fickle. Some will succeed, others will fail. This dynamic holds equally for esports teams, stocks, real estate, etc. However, professional sports leagues like the National Football League (NFL) are structured to insure against loss of investment. Revenue sharing, local market restrictions, and even amateur player drafts are all meant to ensure a certain level of economic and competitive parity.

The opposite is true in esports today – where there is zero loss mitigation. While the NFL has evolved a form of sports socialism (for owners), esports is a raw, free market. An initial investment of seven figures can quickly bleed red ink over time – lacking the proper approach to player salaries, asset control, and game title diversification.

Ultimately, sports clubs like the Cowboys are in the business of winning. Their entire brand identity is fashioned around competitive success. However, the struggles of sports clubs like FC Schalke and other investors from the traditional sports world indicate that there’s no guaranteed crossover effect. So while the cost (in dollars) of buying an esports team might equate to a write-off, the cost (in damage to brand image) of fielding a losing esports team is higher.

True risk, defined

Risk exists everywhere in the world. One of the most dangerous forms of risk, for any investor, is overestimation of how well you really understand an investment. Sports teams – especially those accustomed to success – must ensure they’re exhibiting well-calibrated confidence.

Currently, purchasing an esports teams is the epitome of a seller’s market. For one, buyer demand far outstrips quality supply. Plus, endemics (sellers) have a tremendous knowledge advantage over those outside the space (buyers). Advantages in size and purchasing power aside, investors can’t afford to remain blind to these risks.

Ultimately, not every sports club should take the esports plunge today. Not only that, but there are few assurances for those already “in.” True risk tolerance is being prepared for the consequences of being wrong, not just the probability of being right.

Winning the wager

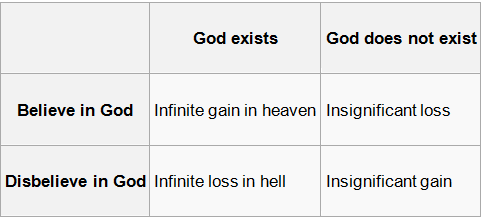

Blaise Pascal – the French mathematician and theologian (1623 – 1662) – originated a wager based in game theory, albeit with a religious bend. The essence of Pascal’s wager is shown below – courtesy of Wikipedia:

The underlying principle is that a finite gain or loss is insignificant compared to an infinite gain or loss. The same can apply to investing in esports. For example, the aforementioned sales-driven approach detailed by the Cowboys’ VP of brand marketing represents a finite gain. Since, should competitive gaming continue to grow as trending, the opportunity to buy a team and recoup the investment cost through sponsorship sales isn’t going to disappear.

“Securing experienced management is absolutely critical. Leading managers have political connections, game knowledge, relationships with players, leagues and media, and most importantly: authenticity. The esports scene is very insular and only by paying your dues can you earn real credibility and authenticity.”

— Jason Lake, owner and founder of Complexity Gaming via Facebook

However, the opportunity to partner with a choice crop of management talent is an infinite gain/loss. Already, management/staff behind the likes of Team Liquid and Team Dignitas are off the market. Likewise, locking up remaining institutional knowledge – embodied by key personnel in esports – is invaluable, and should be the leading motivator for investment today.