Esports teams are becoming a hot commodity. In the past, ownership of a competitive video game organization was for gamers, only. However, influx of capital and ownership from outside the immediate world of gaming is changing that. Yet, this activity outpaces the maturity of techniques used to determine how much teams are worth. Plus, effective valuation models will help avoid an investment bubble for esports clubs.

Valuation: It’s complicated

Competitive gaming organizations are unique creatures. Unlike counterparts in traditional sports, they exist outside exclusive affiliation with a particular league. Sports leagues turn teams – competitors on the field – into economic partners off the field. Cooperation that results in labor market restraints (free agency rules, salary caps, etc.) and product market restraints (revenue sharing, exclusive regional affiliation, etc.). These restraints are designed to increase valuation, not limit it.

Currently esports clubs operate in a free market – with only ownership of video game IP by publishers serving as major constraints. As a result, the topic of valuation is complex. Furthermore, lacking organized protections means clubs must pursue unrestrained utility maximization – competitive success – rather than profitability maximization.

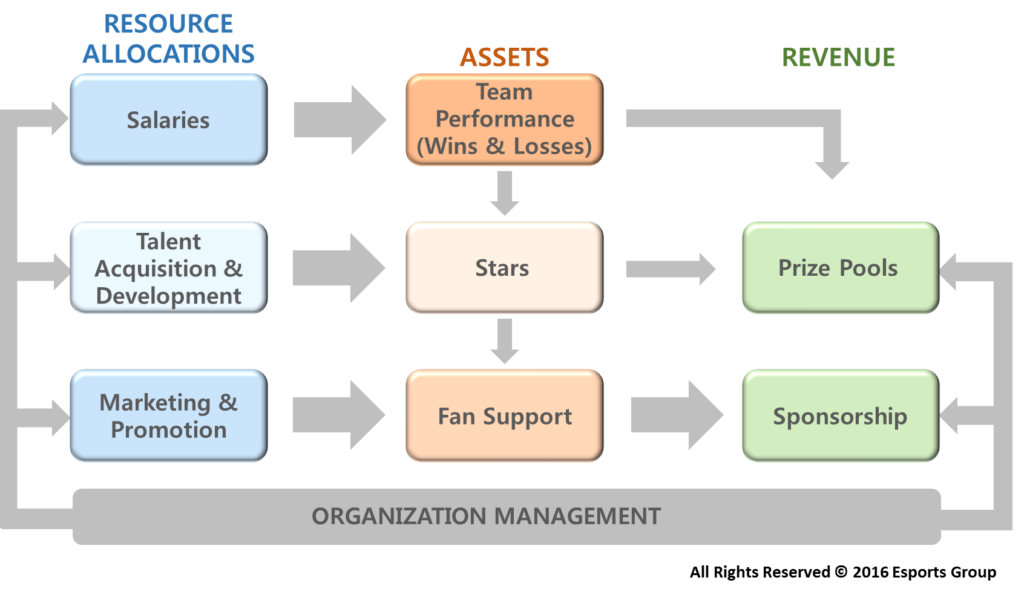

Esports clubs that win are better positioned to generate fans, media and sponsors engagement. Not to mention, prize pool winnings still compose a significant share of revenue flow (see image above). The brand of exclusive leagues found in sports provides a financial safety net for teams aren’t perennially successful. See: guaranteed revenue from broadcast rights sales and league-wide revenue sharing. None of these are widespread in esports today.

The valuation game

Although electronic sport is already capable of generating incredible passion and engagement – from valuable and hard-to-reach audiences – its industry is still bourgeoning. The lack of standard accounting practice and accessibility of revenue figures for esports clubs are notable gaps. This drops financial performance – e.g. earnings – as a dependable valuation metric. It also eliminates commonly used methodologies such as: Discounted Cash Flow (DCF), Market Capitalization, and Revenue Multiple.

Essentially, esports is a hybrid of ‘new wave’ media and sport. Likewise, club valuation must measure the ability to not only win, but also successfully merge video, text, gaming content, and community into engaging experiences. Below is an outline of metrics for an esports team valuation model:

- Proven competitive performance – With teams across multiple game titles, esports clubs are pressured to win on multiple fronts. A track record of fielding championship caliber teams is crucial. So is management that quickly recognizes which new game titles are valuable – towards investing in team growth and player development early on.

- Media and merchandise potential – Expanding media markets –more linear TV broadcasts, channels, and virtual reality content geared towards esports – point to a future for team-centric licensing. Valuable clubs will demonstrate strong fan consumption of team-generated media. Merchandising is already an area where clubs can turn over hard revenue figures.

- Brand integration strength – Sponsor money isn’t free. Strong club brands can support integration with larger non-endemic brands, and justify higher priced partnerships. Creative development and content production capabilities are must-haves.

- Fan behavior analytics – A crucial step towards capturing more revenue per esports fan – estimated at $3.5 per fan in 2016 by Newzoo – is better data. Clubs are in a unique position to capture and deliver analytics about their own fans – beyond standard number of viewers, Facebook likes, and social media followers. A club’s readiness to execute here is a key benchmark.

Outlook

Given the early stage of industry development, expect a high variance in the price tags for mergers, acquisitions or sales of esports teams. However, an increase in deal flow will place a premium on comprehensive valuation models. Ideally, team collectives like the World Esports Association (WESA) and Professional Esports Association (PEA) will promote standard reporting and metrics from member clubs. Especially seeing how smart investments depend on transparent and consistent valuations.