Owning an esports team is becoming pricey. Case in point: spots in Blizzard Entertainment’s upcoming Overwatch League could range from $2 million to $15 million. While most agree that range is too high, there’s a bigger picture. City-based bidding means the long-term success of franchises hinges largely on the regional market fit.

Yet, since the ill-fated Competitive Gaming Series (CGS), the formula for which cities are best suited to host an esports franchise has been irrelevant. Sports economists typically use population, TV market size, corporate base and metro GDP to determine a city’s readiness to host a pro team. Unfortunately, all don’t apply well to digital sport.

Moreover, Newzoo predicts that North America will compose only 13 percent of the eSports global fanbase by 2020. So it’s critical for Blizzard to match teams with the right NA markets early on. In that light, here’s a look at the market metrics and leading strategic locations for US-based Overwatch franchises.

Market metrics

Millennial population growth: While the composition of esports fandom might be different from what you expect, it is largely millennial-driven. Proximity to a growing number of 18-34yr olds equals more consumers more likely to buy tickets and attend events. Apartment List analyzed millennial population trends from Census data between 2005 and 2015; their rankings will be used here.

Metropolitan GDP: Used by economists to measure the importance and performance of metropolitan economies. This metric is a key economic indicator of the health of a metropolitan area.

In-state Fortune 1000 headquarters: Advertising and sponsorship is estimated to generate 60% of the $696 million total esports revenues in 2017 (Newzoo). A healthy number of large, in-state companies are a major plus.

Proximity to sports teams: Chances are Overwatch teams will find their way to mega markets like Los Angeles and New York. However, these cities each host 8+ franchises across the four major professional team sports – baseball, basketball, ice hockey, football. Likewise, the competition for fan attention and advertising/sponsorship spend is fierce.

The locations

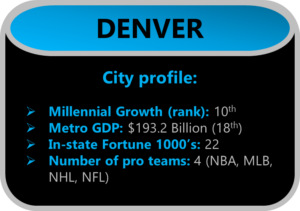

Denver: The capital and most populous municipality in the state of Colorado. The city is also home to major sports teams in the NBA, MLB and NHL. From a tourism perspective, Denver hosted 16.4 million overnight visitors, who spent $5 billion, in 2015. U.S. News and World Report’s 2016 “Best Places to Live” study ranked the city #2.

Minneapolis: The 16th largest metropolitan region in the United States, Minneapolis is the largest city in the state of Minnesota. Minneapolis hosts three pro teams – the Minnesota Timberwolves, Minnesota Vikings, and Minnesota Twins. The metropolitan area is also a top player in the national economy; offering job opportunities across numerous industries, a low rate of job competition – despite a relatively large population.

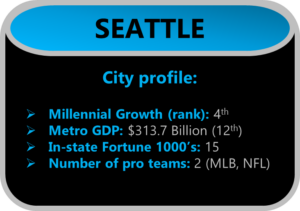

Seattle: A low unemployment rate and strong tech sector, gives the Seattle metro area a very attractive job market. The city has two remaining major sports teams – the MLB’s Seattle Mariners and NFL’s Seattle Seahawks – after the NBA’s Seattle SuperSonics left in 2008. Valve has also hosted its Dota2 International in Seattle for five consecutive years – the last three in Key Arena. So it’s not a stretch to imagine other esports events succeeding in the same venue.

Charlotte: Team EnVyUs – a leading esports organization – is already based in Charlotte, NC after a strategic venture capital investment in 2016. More importantly, the organization boasts one of the world’s top Overwatch rosters. And EnVyUs’ move to Charlotte isn’t coincidental. A new $600 million Hard Rock Casino and a $350 million film studio are both in the works for the city.

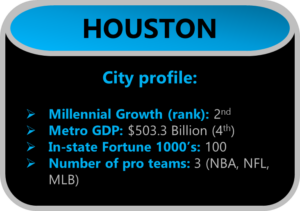

Houston: The Houston Rockets hired Sebastian Park to spearhead esports development in December 2016. But aside from Rockets’ owner, Les Alexander’s, commitment to esports, the city is an emerging hub. Houston just recently hosted Super Bowl LI and is home to 43 Fortune 1000 companies alone. It’s also within driving distance of Austin – home to mammoth campus of the University of Texas.

Outlook

The success of Blizzard’s Overwatch League in the North America region hinges on strategic placement of teams. Cities with 5+ professional sports teams feature far too much competition for fan interest – given the early stage of Overwatch as an esport. And ultimately, city-based Overwatch teams will be gauged on how well they can market esports to a surrounding community, not the glitz and glamour of location.

Data sources: Apartment List (Census Bureau), U.S. Department of Commerce (Bureau of Economic Analysis), Fortune Magazine.