“Torture the data, and it will confess to anything.”

– Ronald Coase, Economist & Nobel Prize Laureate

Data helps define problems and/or opportunities. And Newzoo’s latest free data report, “Why Sports & Brands Want to be in Esports,” does both. Like most research, the findings must be interpreted correctly. To understand as much, here’s an analysis of key points highlighted in the report.

About the money

Reality: Esports in 2016, the global megatrend that it is, remains a predominately digital experience. According to Newzoo, “If esports would generate as much revenues per fan as the NBA, it would be a 2.5Bn business today, or 5 times what it is now.”

Impact: Esports faces very real barriers to NBA-scale revenue generation, which are largely endemic to the digital realm – e.g. people expect things to be free online. Until features like regional market presence, locality and dedicated physical infrastructure are commonplace. Comparison of sports and esports revenue figures is not “apples to apples.”

Additionally, a large chunk of participation and consumption of esports is subsumed by the nearly $100Bn video game industry. Where, competitive video games are already a valuable marketing tool and source of significant indirect revenues. On the other hand, traditional sports are a standalone sphere of activity.

For example, sale of gaming peripherals – the equivalent of sports equipment – doesn’t classify as esports revenues; despite the fact that competitive video games stimulate a significant uptick in peripheral purchases.

Direction: Applying revenue ratios across sports and esports is a tricky subject. Yes, esports will mature as a standalone commercial platform. However, the two mediums currently lack enough structural similarity for unambiguous comparison.

Reaching the unreachable

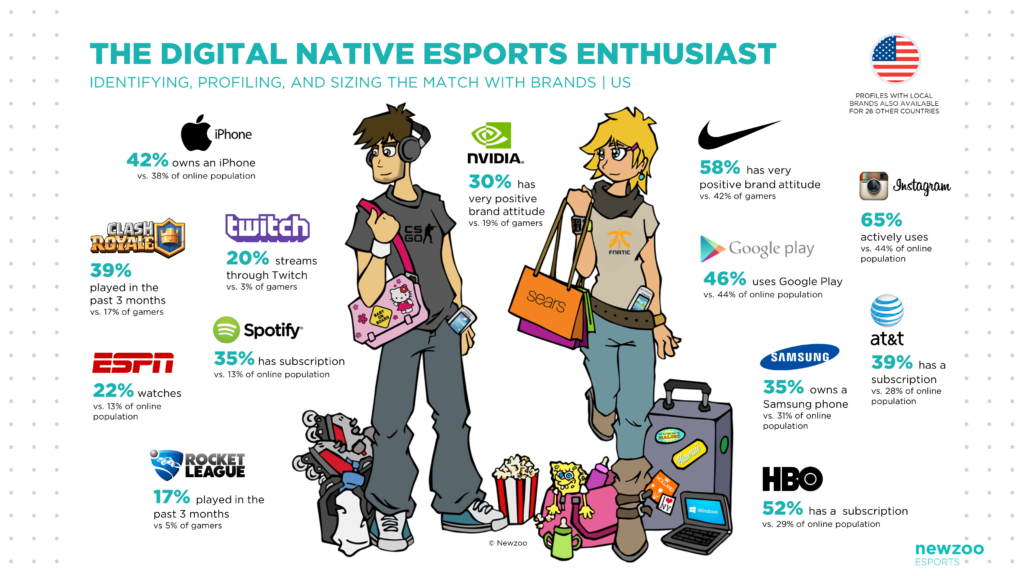

Reality: Gaming culture is the fore bearer of esports. However, all esports fans are not alike. In that light, the Newzoo profiles for matches between esports enthusiasts and brands – measured across all esports fans in the US – needs additional context.

Impact: Esports is a catch-all phrase for a diverse ecosystem of individual game communities. Accordingly, today’s esports market is largely segmented by game title. After that, additional segmentation – e.g. behavioral style, geographic region, etc. – can be applied, so consumers with common needs can be grouped together.

This variety segmentation can quickly slice a sizable target market – 20 million esports enthusiasts in the US according to Newzoo – into smaller, less impressive sounding groups. And while it’s easy to assume that larger target markets are ideal, focusing on smaller and more differentiated targets will yield higher levels of authenticity for non-endemic brands.

Direction: Newzoo data illustrates positive brand perception rates across all esports enthusiasts. However, mass marketing in esports is a misnomer. It’s not as simple as saying, “I want to market to esports fans.” Effecting esports consumers requires focused application of the marketing mix.

The lost generation

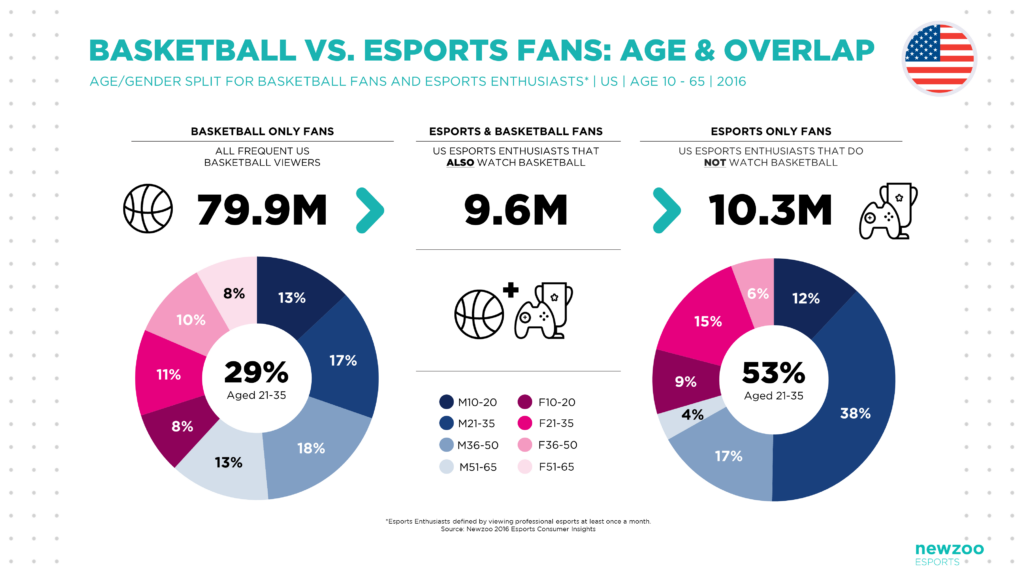

Reality: Newzoo’s data collection around consumption of esports with regards to the Big Four sports – baseball, basketball, football and ice hockey – in America is compelling. Research found that 76% of eSports enthusiasts say esports viewing is taking away from sports viewership hours. Furthermore, there’s evidence that people, of all stripes, are watching less traditional sports.

For example, CivicScience conducted an online poll of 1,063 respondents on behalf of SportsBusiness Journal for September 26 – 28. Among the findings:

- Of those who “closely” follow the National Football League (NFL), 26 percent are watching less live sports on TV, and 23 percent are streaming live sports less often.

- 15 percent have “cut the cord” on television service over the past year. Another 14 percent are planning to do so in the near future.

Impact: Sports viewership is facing severe competition from a nearly endless variety of entertainment options. And more people are substituting sports entertainment with a number of alternatives. So it’s natural that sports fans who are already gamers, overwhelming turn to esports.

However, more crucial is the reported six million esports fans in the US that do not watch baseball, ice hockey, basketball, or American football at all.

The key indicator is that 30% of all esports fans watch zero of the four major sports. For sports properties and brands, this number represents a “lost generation” of fans. A cohort that is, not only difficult to reach, but also largely uninterested in traditional sports.

Direction: The growing segment which is altogether neglecting fandom and those who are reducing viewership, are the sports version of cord cutters and cord shavers. Sports marketers must adapt to the emergence of this new generation of fan, or risk losing them altogether.